You are here:Bean Cup Coffee > news

Bitcoin Price vs Gold: A Comparative Analysis

Bean Cup Coffee2024-09-20 23:50:24【news】5people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, the rise of cryptocurrencies has sparked a heated debate among investors and econom airdrop,dex,cex,markets,trade value chart,buy,In recent years, the rise of cryptocurrencies has sparked a heated debate among investors and econom

In recent years, the rise of cryptocurrencies has sparked a heated debate among investors and economists. One of the most frequently discussed topics is the comparison between Bitcoin price and gold. Both Bitcoin and gold are considered as safe-haven assets, but they have different characteristics and roles in the market. This article aims to provide a comparative analysis of Bitcoin price vs gold, focusing on their historical performance, market dynamics, and future prospects.

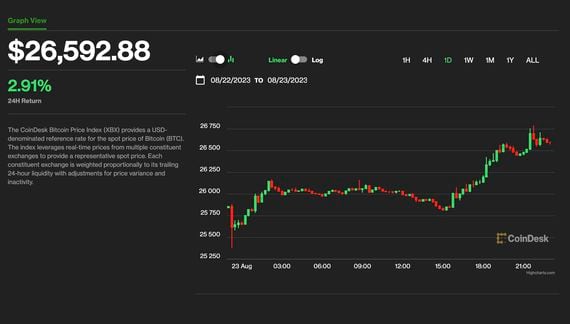

Firstly, let's take a look at the historical performance of Bitcoin price vs gold. Bitcoin, as the first cryptocurrency, was launched in 2009. Since then, its price has experienced significant volatility, skyrocketing to over $20,000 in 2017 and plummeting to around $3,000 in 2018. On the other hand, gold has been a stable investment for centuries, with its price fluctuating within a relatively narrow range. In the past decade, gold has seen its price rise from around $1,200 per ounce to over $1,800 per ounce.

When comparing Bitcoin price vs gold, it's essential to consider the market dynamics that drive their prices. Bitcoin's value is primarily influenced by supply and demand factors, as well as regulatory news and technological advancements. The limited supply of Bitcoin, with a maximum of 21 million coins, has contributed to its price appreciation. Additionally, the increasing adoption of Bitcoin as a payment method and investment vehicle has also played a role in its price growth.

Gold, on the other hand, is influenced by a variety of factors, including inflation, geopolitical tensions, and currency fluctuations. Gold is often seen as a hedge against inflation, as its value tends to rise during periods of high inflation. Moreover, gold is widely recognized as a safe-haven asset during times of economic uncertainty and geopolitical tensions.

Another key difference between Bitcoin price vs gold is their liquidity. Bitcoin is a digital asset, making it highly liquid and easily tradable. Investors can buy and sell Bitcoin 24/7, and it can be transferred instantly across borders. In contrast, gold is a physical asset, which requires time and effort to transport and store. This difference in liquidity can affect the trading volume and price volatility of both assets.

When considering the future prospects of Bitcoin price vs gold, it's important to note that both assets have the potential to appreciate significantly. Bitcoin's price is expected to continue rising as more people adopt it as a payment method and investment vehicle. Moreover, technological advancements, such as the development of the Lightning Network, could further enhance Bitcoin's scalability and adoption.

Gold, on the other hand, is expected to maintain its role as a safe-haven asset. As the global economy faces challenges, such as inflation and geopolitical tensions, investors are likely to turn to gold for protection. However, it's worth noting that gold's price appreciation may be limited by its physical nature and limited supply.

In conclusion, Bitcoin price vs gold presents a fascinating comparison between two distinct assets. While Bitcoin has experienced significant volatility and has the potential for rapid growth, gold remains a stable and widely recognized safe-haven asset. As investors, it's crucial to understand the unique characteristics of both assets and consider their potential risks and rewards before making investment decisions. Whether Bitcoin or gold will outperform the other in the long run remains to be seen, but both assets have the potential to play a significant role in the future of finance.

This article address:https://www.nutcupcoffee.com/btc/42d76599192.html

Like!(85)

Related Posts

- Bitcoin Cash Fork Ledger Nano S: A Comprehensive Guide

- How to Convert Your Laptop to Bitcoin Mining

- How to Trade with Binance Mobile App: A Comprehensive Guide

- Comparison of Bitcoin Wallets: A Comprehensive Guide

- **Bitcoin Wallet in Colombia: A Gateway to Financial Freedom

- How Much Is One Bitcoin in Cash?

- Best Bitcoin Mining App Android 2022: Top Picks for Crypto Enthusiasts

- The Rise and Fall of Bitcoin Price Cash: A Comprehensive Analysis

- Binance New Wallet Address: A Comprehensive Guide to Managing Your Cryptocurrency Assets

- Bitcoin Price 1 Day: A Comprehensive Analysis

Popular

Recent

How to Withdraw to Bank Account from Binance: A Step-by-Step Guide

Bitcoin Australia Wallet: A Comprehensive Guide to Secure Cryptocurrency Storage

How to Generate Paper Wallet Bitcoin: A Step-by-Step Guide

Can U Buy Bitcoin Stock?

Title: Enhancing Your Bitcoin Cash Journey with the Blockchain Bitcoin Cash Explorer

Bitcoin Price USD Investing: A Comprehensive Guide to Navigating the Cryptocurrency Market

How to Generate Paper Wallet Bitcoin: A Step-by-Step Guide

Coinbase Paying Bitcoin Cash: A Game-Changing Move in the Cryptocurrency World

links

- The Rise of Keepass Bitcoin Wallet: A Secure Solution for Cryptocurrency Storage

- Why is Mining for Bitcoins So Much Harder?

- Bitcoin Price and Coin Cap: The Dynamic Landscape of Cryptocurrency

- Title: Unveiling the Power of Source Code Bitcoin Mining Software

- Choosing the right wallet for Bitcoin is crucial for both beginners and experienced users. With so many options available, it can be overwhelming to decide which one to use. In this article, we will discuss some of the most popular Bitcoin wallets and help you determine which one is the best for you. So, what wallet should I use for Bitcoin?

- Can I Use My Own Wallet with Bitcoin Exchange?

- Title: How to Purchase Bitcoin on Cash App: A Step-by-Step Guide

- Bitcoin Cash in Circulation: The Growing Digital Asset

- Bitcoin Wallet Meaning: Understanding the Essential Tool for Cryptocurrency Management

- Upcoming Coins on Binance 2022: A Comprehensive Guide